Self Managed Super Fund Lending – SW Capital

What is a Self Managed Super Fund?

Download our SW Capital Brochure, to learn more.

Discover Your Dreams With an SMSF Loan

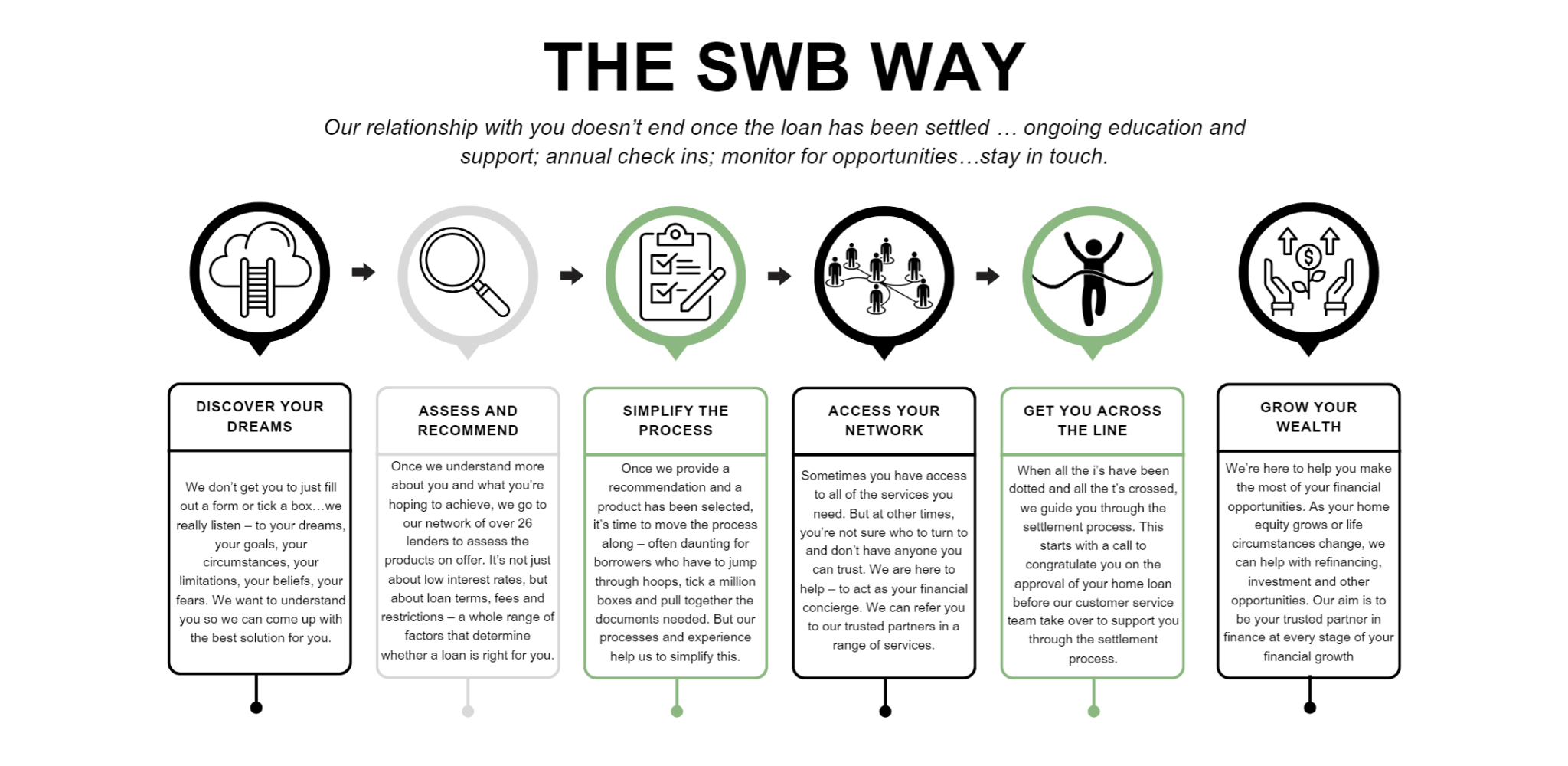

Whether you’re buying your first home, starting a renovation, refinancing, or investing, the first step is understanding your goals. Our ‘Discovery’ stage includes:

- Scheduling a free 15-minute chat at your convenience.

- Identifying your preferred communication method (in-person, email, phone, or online).

- Sending you a secure online link (the fact find) to share your financial details, giving us a complete picture of your situation. This portal lets you upload documents and save progress.

- Once completed, we’ll follow up with a call or meeting to verify details and move to the next step.

Assess and Recommend an SMSF Loan

After understanding your goals, we tap into our network of over 60 lenders to assess a range of products based on factors like interest rates, loan terms, fees, and restrictions. Our job is to identify the best options for your unique situation.

This step includes:

- Presenting a selection of suitable lenders and loan products, with details on fees and repayments.

- Breaking down costs, repayments, and transaction fees for each option.

- Discussing the pros and cons of each loan product, including customer service and flexibility.

- Reviewing your budget and showing how extra repayments can benefit you long-term.

- Providing helpful tools on our website to guide you through the process.

Simplify The SMSF Loan Process

Once an SMSF loan is selected, we simplify the process to avoid the typical hurdles borrowers face. Our streamlined approach and digital tools make it easy for you.

- Upload documents via the portal link from Step 1.

- Use secure access to bank statements through bankstatements.com, saving you time.

- Receive a “Home Loan Shopping Check List” and communicate via the portal.

- Get ongoing updates and support from our team throughout the process.

- Sign documents digitally to speed up the application.

- We lodge the application with the lender, monitor approval, and keep you informed as we liaise with the bank on your behalf.

Access The SW Brokerage Network of Lenders

Sometimes you have access to all of the services you need. But at other times, you’re not sure who to turn to and don’t have anyone you can trust. We are here to help – to act as your financial concierge. We can refer you to our trusted partners in a range of services including real estate agents, property valuers, financial planners, accountants, car brokers, Insurance brokers, stock brokers, quantity surveyors and more.

Once Your SMSF Loan is Approved

Once your SMSF loan is approved, we guide you through the settlement process:

- Our customer service team takes over after approval, helping with loan documents and coordinating with solicitors or outgoing banks.

- We provide updates every 48 hours and notify you of any additional requirements, such as insurance or funds for settlement.

- You’ll meet with us to sign documents (in-person or online via phone/Zoom).

- We ensure all documents are in order, following up with the bank if needed.

- Three days before settlement, we confirm everything is on track with you and the bank.

- After settlement, we follow up within 72 hours to provide your loan number, confirm repayments, and finalise any remaining details.

Grow Your Wealth with Your SMSF Loan

We’re here to help you make the most of your financial opportunities. As your home equity grows or life circumstances change, we can help with refinancing, investment and other opportunities. Our aim is to be your trusted partner in finance at every stage of your financial growth.

- We provide clients with property reports on request, letting you understand the value of your home and see if you can buy an investment property, renovate or upgrade your house.

- We put you in contact with our trusted partners (including financial planners or stock brokers) to help you take steps towards financial growth and asset protection.

- We can also provide the tools (via our SWB Money Hub) to manage your finances and stay in control, letting you move step-by-step towards your financial goals (and letting you see when you get off track).

- This support and knowledge lets you identify opportunities for financial growth and security.

Contact SW Brokerage About an SMSF Loan Today

Self Managed Super Funds – FAQS

What is a self managed super fund?

A Self Managed Super Fund, or an SMSF, is a type of super fund that is managed by the client where the client is the trustee. This allows the client to have more financial autonomy when it comes to managing investments. You can also hire a financial advisor who can help manage the SMSF.

What is an SMSF loan?

An SMSF loan is a limited recourse borrowing arrangement (LRBA) that your superfund enters in order to purchase property as an investment property. How much do I need to pay upfront for an SMSF loan? Schedule a free 15-minute call with our SW Capital experts to discuss how you can apply for an SMSF loan to pay for all investment fees and costs.

What is the average return on investment?

The annual growth rate for residential properties in Australia since 2004 is 6.0% with more data to come on recent property growth rates.

Why is an SMSF better than a traditional super fund?

Traditional super funds don’t allow you the flexibility and autonomy over your financial investments that an SMSF loan can provide. Setting up an SMSF is a great way to access funds to invest into a residential or commercial property investment.

Do SW Brokerage help find and lease investment property?

Our trusted partners with SW Capital can help clients find and lease their investment properties, supporting you at every step of the investing process.

Have more questions about the financial services that SW Brokerage have to offer? Check out the SW Brokerage FAQs for more information about our financial services and our personalised approach to loan brokerage.