As we usher in 2025, it’s the perfect time to reflect on our financial habits and set meaningful savings goals for the year ahead. Whether you’re planning for a big purchase, building an emergency fund, or saving to buy more properties, having a clear financial strategy is essential for success. But how can you ensure you’re sticking to your financial plan or know how you can do this?

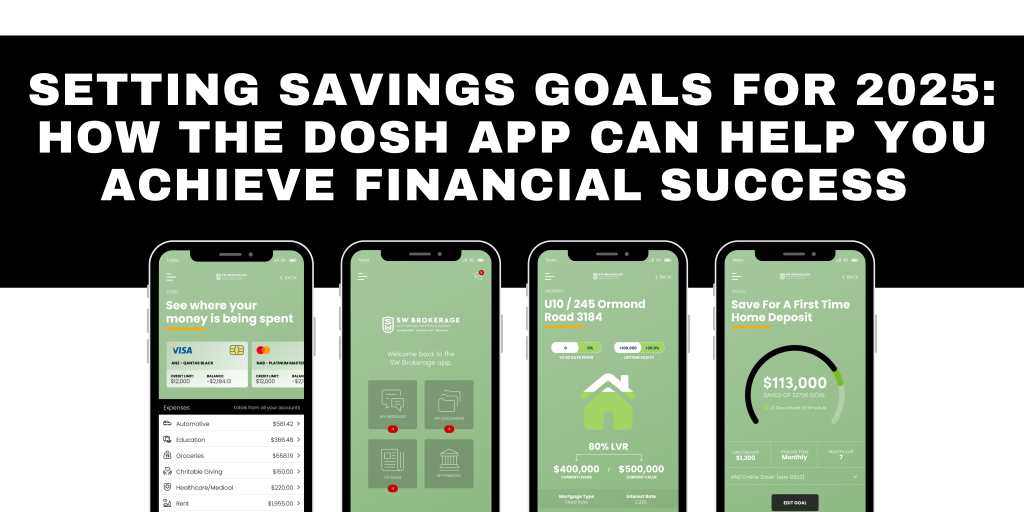

Enter the SWB Dosh Finance App, a user-friendly app designed to help you manage your money more efficiently and make your savings goals a reality.

Why Setting Savings Goals is Crucial for 2025

Research consistently shows that having clear financial goals increases the likelihood of success. According to a 2023 study by the National Bureau of Economic Research, people who set financial goals are 50% more likely to save and stick to their budget than those who don’t. With 2025 in full swing, now is the time to take control of your finances, and setting specific savings goals is the first step.

Here are some common savings goals that many people set:

- Emergency Fund: Aim to save three to six months of living expenses.

- Retirement Savings: Contribute to retirement accounts to secure your future.

- Debt Reduction: Pay off high-interest debt or student loans.

- Home Purchase: Start saving for a Deposit on a house.

- The Right Financial Support: Having an educated financial coach to align with your goals

- Holiday Fund: Set aside money for travel or leisure experiences.

- Big Purchases: Save for a new car, tech gadgets, or other major expenses.

The Role of Technology in Managing Savings

As our lives become more digital, managing money through apps has become a popular and effective way to stay on top of our financial goals. According to a recent survey by Statista, 76% of U.S. adults have used some form of financial app to manage their money, with budgeting and savings tracking being two of the top features they rely on. The rise of these financial tools proves that technology can be a game-changer when it comes to managing your money.

One of the most innovative and effective tools for improving your financial health is the SWB Dosh Finance App. Let’s explore how SWB Dosh can help you stay on track with your 2025 savings goals.

How the SWB Dosh Finance App Can Help You Manage Your Money and Achieve Your Goals

SWB Dosh is more than just a cashback app—it’s a comprehensive finance tool that allows you to track all aspects of your financial life in one place. Let’s take a look at some of the key features that make SWB Dosh an essential app for anyone looking to save more effectively in 2025.

- Convenient Account Overview

One of the main advantages of the SWB Dosh app is its convenience. You no longer need to navigate through multiple banking apps to get a sense of your overall financial picture. The SWB Dosh app brings together all of your bank accounts, credit cards, and investment portfolios into one streamlined view. This saves you time and gives you a clearer picture of your finances without the hassle of jumping from app to app.

- Simplified Budgeting

Budgeting is one of the most powerful tools for reaching your savings goals, but it can also be one of the most difficult to maintain. SWB Dosh simplifies this process by automatically categorizing your transactions and helping you set up a personalized budget. Whether you’re saving for a home or managing monthly expenses, SWB Dosh can automatically track your spending and ensure that you’re sticking to your financial goals. It’s like having a personal finance assistant right at your fingertips.

- Property Tracking and Equity Insights

For homeowners or those planning to buy a home, SWB Dosh also offers property tracking features. You can monitor the value of your property and see how much equity you have. This can help you understand your financial standing and make informed decisions about things like home improvement projects, refinancing, or selling your property. Staying on top of your property’s value is a key aspect of wealth-building, and Dosh makes it simple.

- Share Your Financial Data with Your Broker

Another standout feature of SWB Dosh is the ability to share your financial data directly with your finance broker. This allows you to work more closely with your broker to explore potential financial opportunities. Whether you’re looking to take out a loan, adjust your investments, or discover ways to optimise your savings, having a clear, shared financial picture can help you and your broker provide tailored advice to help you achieve your 2025 savings goals.

Real Stats: How SWB Dosh Can Help You Save

To highlight the effectiveness of the SWB Dosh app, here are some statistics from current users:

- Increased Savings Awareness: 75% of Dosh users report feeling more in control of their finances after using the app for just six months.

- Simplified Budgeting: Users have saved an average of 15% more annually by sticking to budgets set within the app.

- Consolidated Financial Insights: 80% of users say that viewing all of their financial accounts in one place helps them make more informed decisions about their money.

Conclusion: Make 2025 Your Year of Financial Success

With 2025 well underway, now is the time to set and achieve your financial goals. Whether you’re saving for a holiday, a home, or just building a more secure future, the SWB Dosh app offers the convenience and tools you need to make your financial goals a reality. By using SWB Dosh to view all your accounts in one place, simplify your budgeting, track your property value, and share data with your finance broker, you’ll be better equipped to stay on track and reach your savings targets.

Reach out to us today to find out more and how we can onboard you….. TODAY is the day you took control of your financial goals email us on info@swbrokerage.com.au or call us on 1300 792 929