Thinking about getting into the property market or making smarter moves with your mortgage?

This month on the blog, we’re diving into some hot topics that could make a big difference to your finances. From securing a home loan with as little as 2% deposit (and no LMI!) to understanding rising loan repayments, there’s plenty to unpack. We’re also looking at where it’s now cheaper to buy than rent, what the government’s First Home Guarantee extension means for buyers, and how debt recycling could help you build wealth faster. Plus, we touch on the latest electric vehicle trends shaking up the property scene.

Get Into Your New Home Sooner with Low Deposit Home Loans – Up to 98% LVR, No LMI!

SW Brokerage is proud to partner with a trusted lender to help more Australians achieve their property goals with Low Deposit Home Loans of up to 98% Loan-to-Value Ratio (LVR) — all without paying Lenders Mortgage Insurance (LMI).

Enjoy a streamlined application process with same-day AIP (Approval in Principle) for complete submissions and take advantage of highly competitive interest rates: 5.89% p.a. for Owner Occupied and 6.29% p.a. for Investment loans.

With no application, ongoing, or annual fees, plus features like unlimited free pre-payments, free redraw, and cash-out refinancing up to 95% LVR, this is one of the most accessible and flexible loan options available.

Loans of up to $3.5 million are available, with no need for equity sharing or guarantors.

Feeling the Mortgage Squeeze? You’re Not Alone – But Help Is Here

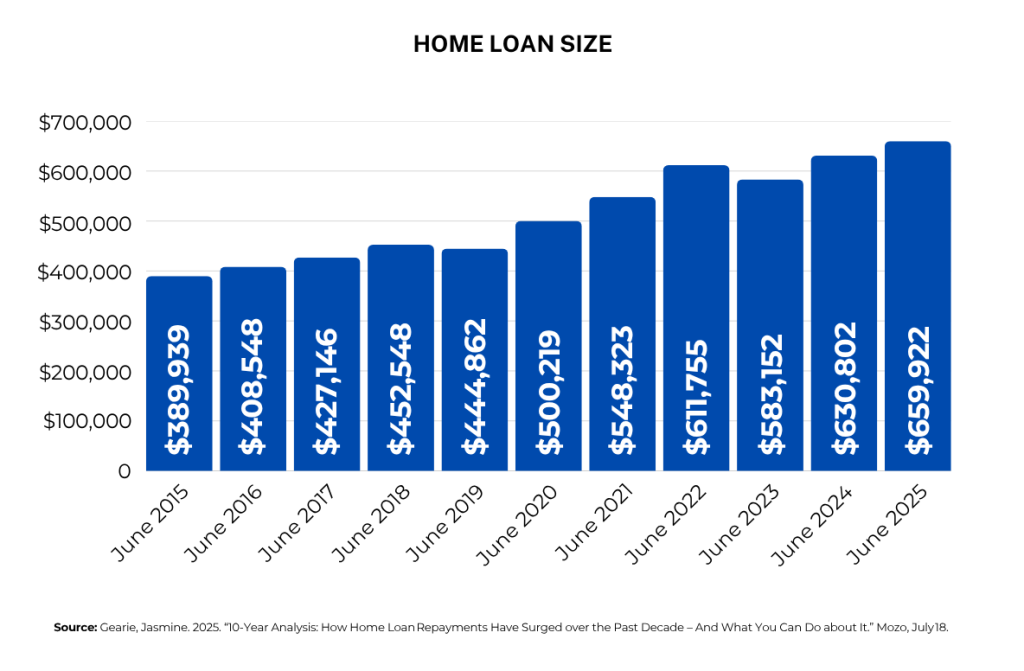

Australian mortgage repayments have nearly doubled over the past decade – rising from an average of $2,214 a month in June 2015 to $4,383 in June 2025, according to Mozo’s analysis of ABS and home loan data. That’s an extra $2,169 a month – or about $71 more every single day for the average borrower. Loan sizes have also surged by 69%, from $389,939 to $659,922, largely due to rising property prices and higher interest rates.

If your repayments are stretching your budget, refinancing could help ease the pressure and improve your cash flow. Whether you’re looking to secure a better rate, reduce monthly repayments, or unlock equity, now is a great time to review your options.

Here are 6 smart tips to refinancing:

- Review your current loan – Understand your rate, fees, and features.

- Compare lenders – Don’t just look at rates; check for hidden costs and benefits.

- Know your equity – The more you have, the better your refinancing power.

- Consider your goals – Lower repayments, fixed rates, or cash-out for renovations?

- Check your credit score – A strong score can unlock better deals.

- Work with a broker – SW Brokerage can match you with competitive options and do the legwork for you.

Let SW Brokerage help you refinance with confidence – so you can enjoy the journey of home ownership without sacrificing your lifestyle.

On the bright side, the savings from switching lenders have more than doubled. Mozo found borrowers could save up to $373 a month by moving from an average rate to the lowest available today, compared to just $180 in 2015. That adds up to almost $4,500 in the first year alone.

In my experience, many lenders don’t pass on rate cuts in full – and some borrowers are still paying well above market rates without realising it. That’s why reviewing your loan regularly is so important. With access to a wide panel of lenders, I can help you find a more competitive rate and guide you through the refinancing process.

If you haven’t reviewed your home loan recently, now might be the ideal time to compare your options.

Saving a 20% deposit is one of the biggest barriers to home ownership – especially for young buyers and renters living in capital cities. But there’s good news: the federal government has just released 50,000 new places under the Home Guarantee Scheme for the 2025-26 financial year.

This program allows eligible buyers to purchase a home with as little as 5% deposit (or 2% for single parents), without needing to pay lender’s mortgage insurance, potentially reducing their upfront costs by tens of thousands of dollars.

The newly released places include:

- 35,000 spots under the First Home Guarantee (for first home buyers).

- 10,000 under the Regional First Home Buyer Guarantee (for regional first home buyers).

- 5,000 under the Family Home Guarantee (for single parents).

This could be your chance to fast-track your move from renting to owning — even if you haven’t reached that 20% deposit milestone yet.

The scheme has already helped over 230,000 Australians step into the market. If you’re keen to explore whether you qualify, reach out and I can help you understand the criteria and get started with the process.

Domain’s latest research has identified select locations across Australia where it’s now cheaper to buy a home than rent one – but those suburbs are becoming increasingly rare.

For houses, just 6.3% of suburbs in capital cities and 27.3% in regional locations were found to favour buyers. For units, the figures were 14.5% in capital cities and 44.3% in regional locations.

That said, home ownership comes with two key advantages – security of tenure and the potential for long-term capital growth.

The suburb with the biggest gap in favour of buying a house was Baynton in Western Australia, where the weekly cost to own a house was $680 less than renting, while for units, Port Hedland (WA) led the way, with a weekly saving of $430 for owners over renters

Domain’s data highlights that buyers are more likely to find value in regional areas and the unit market than in capital city houses.

If you’re thinking about buying but unsure how much you could borrow or what your repayments might look like, I can help. As a mortgage broker, I can crunch the numbers, compare lenders and help you assess whether buying could be financially viable in your situation.