Buying a first home or starting to invest in property should be exciting, but for many Australians it becomes an exercise in avoidance. Over the past few years the goalposts have shifted. House prices are at record highs, and in states such as New South Wales, Queensland, Western Australia and South Australia the average new home loan has increased by around $200,000 over just five years. Prices have risen faster than incomes and cost‑of‑living pressures have squeezed household budgets. Rents have also surged while vacancy rates remain low, making it harder to save a deposit. Exploring options for refinancing your loans can dramatically improve your ability to get ahead of the pack.

In this climate it is understandable that people feel overwhelmed. Money is the number‑one source of stress for Australians, yet it is something we seldom talk about. Many prospective buyers worry that their financial position will be judged or that a broker will tell them they are “not ready”. Others convince themselves that a conversation is pointless until their salary increases or they have a larger deposit. This article explores why these fears are misplaced, what options exist even if you think you are “not ready”, and the real cost of waiting.

For anyone stuck in this situation, SW Brokerage offers a simple, judgement‑free conversation that can put you on the path toward your goals.

The hidden barrier of money shame

Financial stress rarely stems from poor character or laziness. Instead, it often arises from worrying about circumstances beyond our control. Nonetheless, people dealing with money problems often feel ashamed, judged or embarrassed. People also put enormous pressure on themselves to handle everything alone and subsequently blame themselves for their situation. As a result they keep quiet until problems become critical – delaying difficult conversations with their partners and avoiding contact with professionals.

In Western societies we tend to equate success with material possessions and high incomes, so when finances are stretched people feel they have failed. Social media only intensifies this pressure, nobody posts about the mortgage stress or the unexpected bill that wiped out their savings.

It’s no surprise then, that approaching a broker or financial specialist can feel like a public confession. Yet the experts you talk to have seen it all before. At SW Brokerage, while we’ve seen just about every situation possible, our role is not to judge but to guide, and many of the opportunities to improve your position won’t even be on your radar until you speak to someone like us.

Options for refinancing and debt consolidation you probably didn’t know you had

Refinancing to find a better rate and increase savings back in your pocket

One of the most effective ways to improve your financial position is to reduce the cost of your debt. Many borrowers stick with their original lender for years, even when their rate is no longer competitive. The average Australian home loan is about $678,010 and the average variable interest rate is 6.49%. However, the lowest variable rates on the market are closer to 5.09%. On a thirty‑year loan, dropping your rate from 6.49% to 5.09% reduces monthly repayments from roughly $4,281 to $3,678, saving about $604 per month or $7,248 per year.

Even moving to 5.89% – which is still above the best rates but lower than average – would cut repayments by around $263 per month and save more than $3,100 over a year. Over the life of a loan those savings can amount to tens of thousands of dollars. Refinancing may involve fees, but a broker can help you weigh the costs and benefits and negotiate with your current lender.

Consolidating multiple loans to simplify repayments and free up cash

Consolidating other debts into your home loan is another strategy. Credit cards and personal loans often carry interest rates above 15%. Refinancing them into a mortgage with a rate below 6% can drastically reduce your monthly outgoings, freeing up cash for savings or extra repayments. However, it is important to avoid extending the term of the debt unnecessarily. A financial specialist can help structure the loan so you reap the benefits without paying more interest in the long run.

Not all solutions revolve around mortgages. If you have equity in your existing property you might use it to purchase an investment property or undertake renovations that increase your home’s value. For those at the start of their journey, government programmes and specialist lenders offer low‑deposit loans – set up a no-obligation chat with us at SW Brokerage to explore these options.

Real world scenarios

Here’s an example that highlights the very real impact refinancing and debt consolidation can have.

In this case, the borrower was juggling several debts including a home loan, personal loan, car finance and a lease. By consolidating all of these into a single optimised loan, they were able to cut their monthly repayments from roughly $5,700 to $3,700, freeing up cashflow of approximately $2,000 every month. The refinance also allowed our customer to get another $30,000 in equity, which could be used to upgrade their home and boost its value, without resorting to costly short-term credit. With Queensland metro houses gaining equity, this client’s property valued at $1,200,000 with only $450,000 owed to a mainstream lender provides substantial equity to leverage.

The below table outlines the round figures SW Brokerage was able to work with to generate thousands of dollars in savings for our customer.

| Situation | Monthly repayment | Loan structure |

| Before refinancing | ≈ $5,700 | Multiple loans (home loan, car, personal, lease) |

| After refinancing | ≈ $3,700 | Single optimised home loan with equity release |

| Monthly savings | ≈ $2,000 | Simpler structure, more flexibility |

With an extra $2,000 per month freed up, borrowers can put money towards savings or investment plans, while still having the flexibility to use some of the equity for home improvements. Redirecting even half of the monthly savings — say $1,000 — into additional repayments could reduce the life of the loan by several years and cut the total interest bill dramatically.

Why we procrastinate on our finances – the invisible scripts

Fear of judgement is not the only reason people postpone action. We also come up against unspoken assumptions that lead to procrastination.

One of the common scripts we hear is “I’ll call a broker once I’ve saved a bigger deposit”. In a market where values are rising by around 4.1% a year, waiting for the perfect deposit can be self‑defeating. A $800,000 home today becomes a $832,800 home next year if growth continues at current rates, meaning you need to save even more of a deposit just to maintain your position.

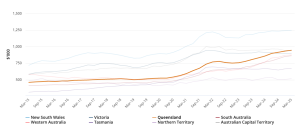

Mean dwelling price in Australia, Qld vs other states & territories

Source: ABS Data (https://www.abs.gov.au/media-centre/media-releases/average-australian-dwelling-price-reaches-1-million)

Another common reason for delaying action we hear is “we’ll talk to someone when we find a house”. Unfortunately, making an offer subject to finance when you have not explored your borrowing capacity can leave you disappointed or cause delays that allow someone else to swoop in.

People also misjudge their own eligibility. They assume that banks will not lend to them because they do not have a 20% deposit or because they have other debts. The truth is more nuanced. There is a wide range of loan products available, including those designed for borrowers with smaller deposits or complex circumstances. Refinancing or consolidating debt can improve cash flow; using a guarantor or government guarantee may reduce deposit requirements; and some lenders will accept non‑traditional forms of income. Without talking to someone who knows the market, you may be missing out on options.

Finally, some borrowers wait for macroeconomic conditions to change. They hope interest rates will fall further or property prices will correct. While it is rational to watch the market, trying to time it perfectly can backfire. Advertised listings are around twenty per cent below the five‑year average, creating a “seller’s market”. Demand continues to outpace supply and real wage growth is at its strongest level in five years. These factors suggest there is no guarantee prices will drop in the short term, and sitting on the sidelines may mean paying more later.

The cost of waiting – what procrastination really costs

Delaying a decision can feel safe, but in a rising market it comes at a price. Consider the effect of continued property price growth. The table below illustrates what happens if home values rise by 4.1% over the next twelve months. The cost of your dream home or investment property increases significantly while you are saving.

| Current property value | Value after 1 year at 4.1% | Increase in purchase price |

|---|---|---|

| $600,000 | $624,600 | $24,600 |

| $800,000 | $832,800 | $32,800 |

| $1,000,000 | $1,041,000 | $41,000 |

| $1,200,000 | $1,249,200 | $49,200 |

Such increases may outstrip your ability to save. A household putting aside $2,000 a month accumulates $24,000 in a year – barely enough to cover the price rise on a $800,000 property. Meanwhile, you miss out on rental income that an investment property could generate. A 3.74% yield on a $600,000 property equates to roughly $22,440 in gross rent. Even if you factor in mortgage payments, maintenance and vacancies, the net income can help service the loan or build savings.

Add to this the refinancing savings discussed above and the cost of waiting becomes clear. Inaction may feel comfortable or even responsible, but it often has a higher opportunity cost than taking a considered risk.

Breaking the cycle – how a conversation about your financial goals changes everything

One of the most powerful antidotes to money shame is information. Talking openly with a trusted professional can demystify the process, reveal options you did not know existed, and provide reassurance that your situation is not unique. Many people find that just articulating their goals and concerns reduces anxiety. A broker like SW Brokerage can help you prioritise debts, calculate borrowing power, explain complex terms and take actions to improve your credit profile.

The benefits extend beyond the initial transaction. SW Brokerage’s philosophy is that settling a loan is only the beginning of the relationship. Regular check‑ins ensure your loan remains competitive as market conditions change, and you can adjust your strategy if your circumstances shift. If interest rates drop, you might refinance to save money. If they rise, you can discuss options to lock in a rate or reduce risk. Ongoing support also means you will be better prepared for future milestones, such as upgrading your home, investing in property or funding a child’s education.

At SW Brokerage we also act as your financial concierge, connecting you with our trusted list of accountants, advisers and buyers’ agents as needed.

Making a move toward your financial future – what to expect

Taking action does not require perfection. You do not need to have a 20% deposit, a flawless credit history or even a clear idea of your goals before speaking to someone. A home loan broker will ask about your income, expenses, existing debts and savings and will help you calculate your borrowing power. It can be helpful to gather recent payslips, bank statements and any loan documents, but do not let paperwork become another barrier. Your adviser can guide you through the requirements.

The initial conversation is free of charge and obligation. At SW Brokerage, for example, we offer our clients a fifteen‑minute discovery call to discuss their situation and goals. During that conversation you can ask questions about loan products, refinancing and investment strategies, and you will receive honest feedback about what is possible and what steps to take next.

At that point even if you are not ready to proceed, you will at least have a roadmap to reduce your feelings of financial anxiety.

Taking charge of your money matters

Embarrassment and fear of judgement are powerful emotions, but they should not dictate your financial trajectory. The evidence suggests that waiting for the “right” moment can be costly. House prices continue to climb, rents and living costs remain high, and the difference between average and best interest rates means refinancers who act promptly can save thousands of dollars a year.

There are more options available than many people realise, from low‑deposit loans such as SW Brokerage’s 2% deposit product to debt consolidation and investment strategies.

The first step is often the hardest, but it can also be transformative. A short conversation with a financial lending specialist will not solve all your problems, but it can replace uncertainty with a plan. Whether you are dreaming of your first home, looking to reduce your monthly repayments or exploring ways to build future wealth, you owe it to yourself and your family to make contact with SW Brokerage today and take the first step.

Right now, there are also short-term incentives that can make refinancing even more attractive. As of September 2025, ANZ is currently offering a $2,000 cashback rebate for eligible customers who refinance their home loan of $250,000 or more (with 80% LVR or less). This offer ends on 30 September 2025, making now an opportune time to explore whether refinancing could both save you money and deliver a one-off cash benefit. Bring this up with us at SW Brokerage and we will organise the whole process pain free.